Canfield Income Tax Department

The City of Canfield Income Tax Department is responsible for administering and applying the provisions of the City of Canfield income tax regulations.

All residents of the City of Canfield are subject to the 1% income tax imposed by City Ordinance, and must file an annual return with the City of Canfield Income Tax Department.

The City of Canfield Income Tax Department strives to provide our residents with exceptional services in a professional and courteous manner. Please contact our office with any questions. Phone: (330) 533-1101.

Ashley Christopher

Tax Administrator

[email protected]

INCOME TAX REMINDERS:

Tax filing deadline for 2025 is APRIL 15, 2026

Days

Hours

Minutes

City of Canfield

2025 E-File is now available!

Taxpayers can utilize the E-Filing website to file/pay current year’s tax return, pay/check estimates, and upload digital copies of their tax documents (such as W-2’s or Federal 1040) for both current and prior years.

Millennial Moments JEDD

2025 E-File is now available!

Credit Card Payments

To pay via credit card, please use the link below. Please complete the Notes section with the name of the person the payment should be applied to and a brief description of what the payment is for.

E-File

The City of Canfield E-File/E-Pay System

-

File/Pay Tax Return

-

Upload current and prior year documents directly to the city

-

Check prior year’s estimates and credit carry-forwards

-

File Extension

-

Pay current year’s Quarterly Estimates

Registering With Our Office

PLEASE NOTE: If you’ve previously filed a return with our office, received any type of notice or bill from us, you are already registered and will only need to set up your PIN.

- To utilize the E-File/E-Pay System, you will first need to register with our office so that you may set up a PIN.

- Please complete the individual registration form and return it to our office.

- Once received, the information will be entered into our system and you will be able to set up a PIN.

- If you’ve mailed your completed registration form, please allow one week before attempting to set up a PIN.

- If you’ve faxed your completed registration form, please allow 48 hours to pass before attempting to set up a PIN.

Setting Up a PIN

- Input your social security number (or the primary’s social security number in the case of a joint account) and create a PIN number by clicking on the “Don’t have a PIN?” link next to the log in screen’s PIN field. If your social security number does not work, try your spouse’s.

- Make sure that you’ve updated your address with our office, as your current house number is required when setting up your new PIN.

- The PIN is required to be a combination of letters and numbers (anywhere from 4 to 10 characters). Any letters that are part of your PIN are case sensitive.

- You will receive confirmation of your PIN’s creation on the log in page.

Once you’ve created your PIN and logged into our system, you may prepare your current year’s City of Canfield income tax return online, file an extension, upload current year and prior year tax documents, and/or check your estimates and prior year credits.

What documents will I need?

Before you sit down to E-file your City of Canfield Tax Return, please make sure you have the following documents available in order to reference and to upload into our E-File system:

1

W-2’s

Make sure to enter & upload all W-2’s. If you receive credit for other city withholding, make sure the uploaded W-2’s show the amount withheld.

2

Federal 1040

Federal tax return must be filed prior to filing City of Canfield return. First page of Federal 1040, as well as Schedule 1 must be uploaded for return to be complete.

3

Payment Info

If you have a tax balance due and wish to pay online, please have your bank account & routing number available. Payment can also be made with credit card, but there is a processing fee.

Individuals

Who must file:

- Every City of Canfield resident eighteen years of age and older: must file a Canfield income tax return. The only exception to this is to file an annual Exemption Form if you are registered with the tax department as retired and/or disabled and your income is not subject to municipal income tax.

- Every non-resident individual: earning income in the City of Canfield not subject to employee withholding of Canfield income tax must file an annual Canfield income tax return.

- Every non-resident individual: with rental property or engaged in a business or profession in Canfield must file an annual Canfield income tax return.

- Partial-year residents: must file for the time spent as a resident of the City of Canfield. Income may be pro-rated for the time lived in Canfield. Income and tax credits may be pro-rated for the time lived in Canfield. Attach a worksheet to your return explaining your calculations.

Income Tax Forms

Quarterly Estimates

The City of Canfield requires persons who expect to owe more than $200.00 in tax for the current filing year to make quarterly estimated tax payments.

Estimates for the current year are billed quarterly, with the exception of the first quarter—which is due to be paid with your tax return by the April filing deadline. The remaining three quarters are due by June 15th, September 15th, and January 15th. If you wish to pay your full estimate at once, you may do so.

To avoid penalty and interest, you must pay 100% of your prior year’s tax (as current year’s estimate) or 90% of your current year’s actual tax liability by the 4th quarter due date for individuals and calendar year businesses, respectively. Fiscal year businesses must remit by the last day of the month following their taxable year.

To declare an estimate if you have not already done so, or to amend your declaration of estimated tax for the current year, please complete our Quarterly Estimate Voucher.

Please contact the City of Canfield Income Tax Department with any questions.

Tax Filing Resources

I cannot locate the documents needed to file my City of Canfield tax return (W-2’s, Federal 1040, etc.):

Please use this IRS link to request transcripts of past tax returns, tax account information, wage and income statements and non-filer letters.

Please use this Social Security link to access your personal earnings history which may be needed to file tax returns for previous years.

I do not know whether or not I live within the city limits of Canfield:

Please use this link to the Mahoning County Auditor’s website and search by address to see whether or not you live in the city limits.

Businesses/Employers

The City of Canfield imposes a local tax of 1.0% on all income earned within the city. The tax is levied on both the net income and the business earned in the City of Canfield and on the wages, salaries, and other forms of compensation earned by employees of the company in the City of Canfield.

In addition to fulfilling its own tax obligations to the City, any general contractor also has the responsibility of notifying its subcontractors of the Canfield income tax.

Register with the City of Canfield:

If you have not established accounts with the City of Canfield for the purposes of filing the required business and withholding tax returns, please click on the applicable button below to complete the proper registration form and return it to our office:

-

Business Registration Form

Also, if applicable:

Attention! Before completing employer withholding form, please search employee’s address using the following link:

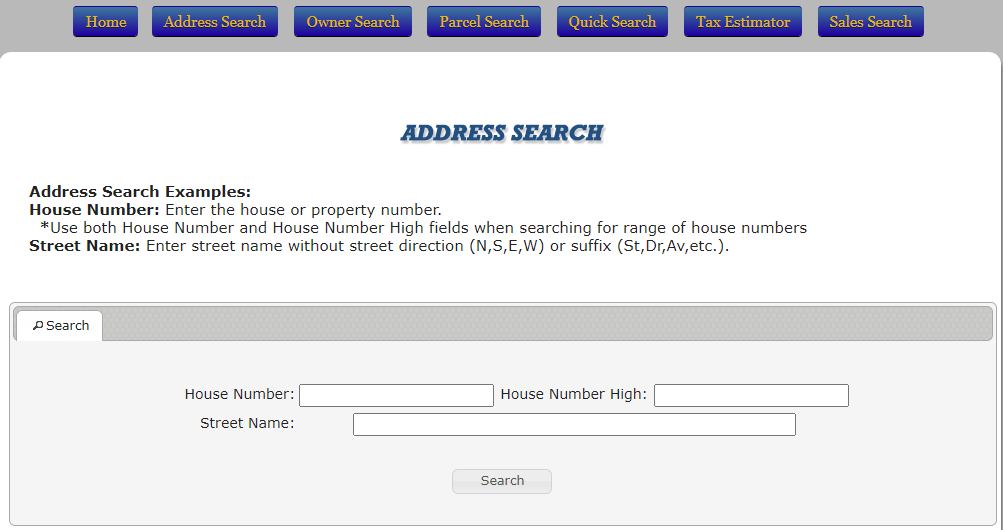

Mahoning County Auditor Property Search

Search employee(s) address:

If the employee is a resident of Canfield city, the search result will show the following:

Then, complete form below to register with the city.

Attention! Before completing employer withholding form, please search employee’s address using the following link:”, “description”: “Mahoning County Auditor Property Search”, “step”: [{“@type”: “HowToStep”, “name”: “Search employee(s) address:”, “image”: “https://canfield.gov/wp-content/uploads/2022/01/MCA.png”, “itemListElement” :[{ “@type”: “HowToDirection”, “text”: “”} ]} ],”yield”: “

Then, complete form below to register with the city.

“, “image”: “https://canfield.gov/wp-content/uploads/2022/01/MCA2.png”}

Employee Withholding

Business/Net Profit Filing

Who must file:

- Corporations: C-Corporations & S-Corporations are required to file as entities on the net profit or loss derived from sales made, work done, services performed or rendered and business or other activities conducted in City of Canfield, whether or not the corporation has a place of business in Canfield.

- Partnerships: Partnerships are required to file as entities on the net profit or loss derived from sales made, work, done, services performed or rendered and business or other activities conducted in the City of Canfield, whether or not such partnership has a place of business in Canfield.

- LLCs: A limited liability company is required to file consistent with its federal filing. For example, if the LLC is recognized as a partnership at the federal level, it should file as a partnership at the local level. Single member LLC’s that report net profit or loss on Federal form 1040, schedule C should file as an individual taxpayer at the local level.

- Miscellaneous Entities: Any undertaking, not specifically defined above, conducting activities or producing income, including but not limited to, rental of real estate and personal property, and a business conducted by a trust or guardianship of an estate that produces a net profit shall be subject to city income tax and is required to file a return as an entity.

Tax Ordinances

Taxpayer Rights & Responsibilities

“TAXPAYERS’ RIGHTS AND RESPONSIBILITIES” means the rights provided to taxpayers in sections 718.11 , 718.12 , 718.19, 718.23, 718.36, 718.37, 718.38, 5717.011 , and 5717.03 of the Ohio Revised Code and any corresponding ordinances of the Municipality, and the responsibilities of taxpayers to file, report, withhold, remit, and pay municipal income tax and otherwise comply with Chapter 718 of the Ohio Revised Code and resolutions, ordinances, and rules adopted by a municipal corporation for the imposition and administration of a municipal income tax.

These rights and responsibilities include, but are not limited to, the following:

The municipal corporation shall maintain a Local Board of Tax Review to hear appeals of the taxpayer on assessments issued by the Tax Administrator. The Taxpayer or the Tax Administrator may appeal the Final Determination of the Local Board of Tax Review.

Civil actions to recover municipal income tax, penalties and interest have time limits.

Taxpayer has a prescribed manner in which to request a refund from the Tax Administrator.

Taxpayer has a required responsibility to timely and accurately file annual returns, reports, documents, and to timely remit all taxes due on such annual returns, reports, documents and filings.

At or before the commencement of an audit (where the tax administrator has ordered the appearance of the taxpayer), the Tax Administrator shall inform and provide the Taxpayer with certain information regarding the audit.

Taxpayer has a required responsibility to allow examination of their books, papers, records, and federal and state income tax returns by the tax administrator.

Taxpayer has certain recourse if aggrieved by an action or omission of the Tax Administrator, their employee or an employee of the municipal corporation.

Unpaid Tax Interest Rates

Ohio Revised Code 718.27 requires the Tax Administrator to publish, by October 31st, the established interest rate for tax underpayments based on the federal short-term rate that will apply during the next calendar year.

Interest shall be imposed per annum, on all unpaid income tax, unpaid estimated income tax and unpaid withholding tax.

The interest rate used shall be the federal short-term rate (rounded to the nearest whole number percent) plus five percent (5%). The rate shall apply for the calendar year next following the July of the year in which the federal short-term rate is determined.

Note: Interest applies to any balance of tax due that is not paid by the due date of a return, even if the return is filed under extension.

| Calendar Year | Yearly Interest Rate |

|---|---|

| 2018 | 6.0% |

| 2019 | 7.0% |

| 2020 | 7.0% |

| 2021 | 5.0% |

| 2022 | 5.0% |

| 2023 | 7.0% |

| 2024 | 10.0% |

| 2025 | 10.0% |

| 2026 | 9.0% |

City of Canfield

Income Tax Department

104 Lisbon St.

Canfield, OH 44406

Phone: (330) 533-1101

Fax: (330) 533-2668

Email: [email protected]

Hours of operation are:

Monday through Friday

8:00 AM to 4:30 PM